On July 26, 1979, the U.S. government enacted the Trade Agreements Act (TAA) 19 U.S.C. ch. 13 (19 U.S.C. §§ 2501–2581). The TAA is an Act of Congress governing trade agreements negotiated between the U.S. and foreign countries under the Trade Act of 1974. One of the key components of the TAA is that it regulates the U.S. government’s procurement of American-made products or products produced in designated countries. Secondly, the Trade Act Agreement promotes positive relationships with countries aligned with the U.S. that mutually profit both parties. For a product to be considered TAA compliant, it must have been produced or otherwise mostly assembled within the U.S. or within another TAA compliant country. Furthermore, products that come from TAA compliant countries with certification that guarantees their compliance. Such products are referred to as “TAA compliant.”

- §2502 Congressional statement of purposes:

- To approve and implement the trade agreements negotiated under the Trade Act of 1974 [19 U.S.C. 2101 et seq.];

- To foster the growth and maintenance of an open world trading system;

- to expand opportunities for the commerce of the United States in international trade; and

- To improve the rules of international trade and to provide for the enforcement of such rules, and for other purposes.

What Is TAA Compliance?

A TAA-compliant product is defined as 1) having a minimum of 50% of its total cost gleaned from the United States or TAA-designated countries; 2) the product has undergone a “substantial transformation” within the United States or TAA-designated countries.

What Is the Goal Behind the TAA?

What Is the Goal Behind the TAA?

The goal behind the TAA’s creation is to authorize government program management offices (PMOs) such as the General Services Administration (GSA) to acquire only those products and services that are produced or substantially transformed in the United States or in one of the TAA-designated countries.

A Brief Definition of a PMO

A PMO is defined as a department or group within an organization (whether profit or nonprofit), governmental agency, or any other type of enterprise that determines and maintains project management standards within those organizations. PMOs aim to introduce and standardize certain economies into the repetitious completion of future projects. PMOs are also the primary source of guidance, documentation, as well as metrics on the application of project management standards and implementation.

Eric John Darling and Stephen Jonathan Whitty of Emerald Publishing, one of the “leading digital-first” PMOs, have pointed out in prior works that the interpretation of the PMO’s purpose has evolved over time.

Darling and Whitty stated: “The Project Management Office (PMO) phenomenon is a dynamic and regularly evolving feature of the project landscape. The functions and practices expected of the PMO differ as widely as the industries and organizations which host them.” Their article put forth the following examples of these changes over time.

- In the 19th century, the PMO acted as a sort of “national governance” for the agricultural industry.

- Towards the end of the 1930s, the PMO began to appear as the “project management office” in certain publications.

- During the 1950s, the PMO concept was indicative of contemporary PMO.

- Presently, PMOs are dynamic entities employed to resolve specific issues.

There exist several types of PMOs:

- Project Management Center of Excellence (PMCoE)

- Enterprise PMO

- Project PMO

- Divisional PMO

The Project Management Institute (PMI) Program Management Office Community of Practice (CoP), expounds on the idea of the PMO as a vital driver for organizations to pursue excellence in what they do. It also seeks to strategically change leadership, modes of performance management, and organizational governance.

What Does “substantially transformed” Mean Exactly?

As per the Trade Agreements Act, “substantial transformation” is when a product or service is changed or “transformed” considerably. This could mean something as simple as its name or something as significant as its overall character. “Substantial transformation” could also be how the product or service will be used by the end-user. But in order to be considered a substantially transformed product or service, the transformation must have taken place within the country of origin.

Nevertheless, being able to verify that a product or service underwent its substantial transformation within its country of origin is often a subjective and tenebrous process depending on what part of the world it comes from. That is meant to say that just because certain countries have been given TAA designation doesn’t mean they actually earned it. This means they’re prone to cutting corners and have falsified records.

Because of this murkiness, fact gathering and meticulous scrutiny of products and services coming from certain countries should be conducted to determine and verify TAA compliance. United States legislation has established that merely assembling a product within the country or TAA-designated countries isn’t equivalent to the TAA’s definition of substantial transformation.

The Substantial Transformation Rule

You can thank the case of Anheuser-Busch Brewing Association v. The United States, 207 U.S. 556, 562 (1908) where the United States Supreme Court applied “substantial transformation” as a rule.

Thus, for well over a century, it has been so throughout customs laws and rulings in the United States to ascertain the origin of products and services for reasons such as control of the United States textile import program; for preferential trade programs eligibility; country of origin marking; the drawback of duties; American goods returned; admissibility and, of course, government procurement under the Trade Agreements Act of 1979.

According to Tuttle Law:

“The essence of the substantial transformation rule is that a product cannot be said to originate in the country of exportation if it was not manufactured there. The question, therefore, has been whether operations performed on products in the country of exportation are of such a substantial nature so as to justify the conclusion that the resulting product is a manufacture [sic] of that country.

“In Anheuser-Busch Brewing Ass’n the Supreme Court said:'[m]anufacture implies a change, but every change is not manufactured [sic] * * *. There must be transformation; a new and different article must emerge, “having a distinctive name, character, or use.”‘”

Tuttle Law continues to explain that the Court of Customs & Patent Appeals upheld the rule of “substantial transformation” in United States v. Gibson-Thomsen Co., Inc., 27 C.C.P.A. 267 (C.A.D. 98) (1940), stating that a product must undergo “further manufacturing or processing, the product loses its identity and is transformed into a new product having a new name, character, and use.”

Further, the concept of substantial transformation is of significant importance when applying customs and trade laws in the United States—a fact that can be duly noted in Tropicana Products, Inc. v. United States (6 C.I.T. 155, 159, 789 F. Supp. 1154,1157 (1992)).

Several Examples of Products And/Or Services That Didn’t Meet the TAA’s Definition of “substantial Transformation”

Examples of products and/or services that don’t meet the TAA’s definition of “substantial transformation” can be found below.

- In 2013, the United States Customs and Border Protection, the largest federal law enforcement agency of the United States Department of Homeland Security, ruled that Ethernet switches assembled in Malaysia and subsequently shipped to Singapore to have software created in the United States downloaded was not substantial transformation.

- In the 1983 case of Uniroyal, Inc., v. United States, the United States Court of Appeals ruled that sewing a sole onto an otherwise fully manufactured shoe didn’t “substantially transform” footwear products imported from a non-TAA-compliant country.

- In 2011, the United States Customs and Border Protection found that operations such as “fit-together” and “screw operations” performed in Taiwan didn’t substantially transform certain products originating from China.

Below we’ve provided a couple of TAA-compliant product examples.

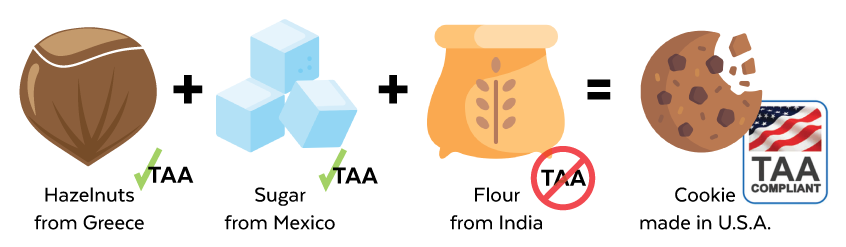

1. A Cookie Product Comprised of Ingredients From a Non-TAA-compliant Country

If a food manufacturer imports hazelnuts from Greece, sugar from Mexico, and flour from India as part of a cookie product recipe, those ingredients have been substantially transformed—or more like totally transformed.

You should take note that those three ingredients were imported from those countries untransformed, with India being a country that isn’t TAA compliant. Even though the flour came from India untransformed, it was used to produce the cookies in the United States, which means they originated from the United States—this, of course, makes them TAA compliant.

2. A Toddler’s Toy Consisting of Three Parts

- The first part comes from China, comprising around 15% of the total cost;

- The second part comes from Canada, comprising approximately 25% of the total cost;

- The third part is imported from Taiwan, comprising 40% of the total overall cost;

- At last, the product is manufactured in the United States at 20% of the total cost.

As China only consists of 15% of the total overall cost of production—a non-TAA-compliant country—the finished product is considered TAA compliant.

What Countries Have Been Designated TAA Compliant?

One of the most prevalent questions people typically ask us is whether countries like Japan and China are TAA compliant. Therefore, we’ve decided to include a complete list of TAA compliant countries, as well as those that are not TAA compliant. However, since geopolitics is ever-evolving, it’s important that you do your own personal research on what countries are and aren’t TAA compliant.

We should not be held liable for any dealings one does if they have failed to verify whether the information in this article is up to date.

With that said, as of 2021, China definitely is not TAA compliant. On the other hand, Japan is TAA compliant. In addition to that, four categories or groups of countries are acknowledged by the United States and officially registered as TAA compliant on the Federal Acquisition Regulation (FAR) registry. They are as follows:

- Countries that are a part of the Free trade Agreement (FTA). According to trade.gov, “A Free trade Agreement (FTA) is an agreement between two or more countries where the countries agree on certain obligations that affect trade in goods and services, and protections for investors and intellectual property rights, among other topics. For the United States, the main goal of trade agreements is to reduce barriers to U.S. exports, protect U.S. interests competing abroad, and enhance the rule of law in the FTA partner country or countries…Currently, the United States has 14 FTAs with 20 countries.”

- Member countries of the World Health Organization (WHO) that are parties of the Government Procurement Agreement (GPA). According to the WHO, “The Agreement on Government Procurement (GPA 2012) consists of 21 parties (covering 48 WTO members, counting the European Union and its 27 member states as one party). Another 35 WTO members/observers and four international organizations participate in the Committee on Government Procurement as observers. Eleven of these members with observer status are in the process of acceding to the Agreement.”

- Caribbean Basin Countries as per ustr.gov.

- Least Developed Countries as per unctad.org.

Below, we’ve included lists of all the countries that are TAA-compliant as of the date of writing. They will be listed under their designated group.

(Note: Countries have been listed under their official names. Press “CTRL” + “F” and type or paste the name of the country you’re looking for to do a quick search.)

Free Trade Agreement Countries

✔ Commonwealth of Australia

✔ Nicaragua

✔ Sierra Leone

✔ Kingdom of Bahrain

✔ The Sultanate of Oman

✔ Solomon Islands

✔ Canada

✔ Panama

✔ Federal Republic of Somalia

✔ Chile

✔ Peru

✔ Republic of South Sudan

✔ Colombia

✔ Republic of Singapore

✔ Tanzania

✔ Costa Rica

✔ Islamic Republic of Mauritania

✔ East Timor

✔ The Dominican Republic

✔ Mozambique

✔ Togo

✔ Republic of El Salvador

✔ Nepal

✔ Tuvalu

✔ Guatemala

✔ Nigeria

✔ Uganda

✔ Honduras

✔ Republic of Rwanda

✔ Vanuatu

✔ Republic of Korea

✔ Independent State of Samoa

✔ Republic of Yemen

✔ United Mexican States

✔ São Tomé and Príncipe

✔ Zambia

✔ Morocco

✔ Republic of Senegal

WHO GPA Countries

✔ Armenia

✔ Hong Kong Special Administrative Region

✔ New Zealand

✔ Aruba

✔ Hungary

✔ Norway

✔ Commonwealth of Australia

✔ Iceland

✔ Republic of Poland

✔ Republic of Austria

✔ Ireland

✔ Portugal

✔ Belgium

✔ Israel

✔ Romania

✔ Bulgaria

✔ Japan

✔ Republic of Singapore

✔ Canada

✔ South Korea

✔ Slovak Republic

✔ Republic of Croatia

✔ Latvia

✔ Slovenia

✔ Republic of Cyprus

✔ Liechtenstein

✔ Spain

✔ The Czech Republic

✔ Republic of Lithuania

✔ Sweden

✔ Estonia

✔ Luxembourg

✔ Switzerland

✔ Finland

✔ Malta

✔ Taiwan (officially the Republic of China (ROC))

✔ France

✔ Moldova

✔ Ukraine

✔ Germany

✔ Montenegro

✔ United Kingdom (made up of England, Scotland, Wales, and Northern Ireland)

✔ Greece

✔ Netherlands

Caribbean Basin Countries

✔ Antigua and Barbuda

✔ Dominica

✔ St. Kitts and Nevis

✔ Aruba

✔ Grenada

✔ St. Lucia

✔ Commonwealth of The Bahamas

✔ Guyana

✔ St. Vincent and the Grenadines

✔ Belize

✔ Haiti Sint Eustatius (also spelled Eustachius or Eustathius)

✔ Bonaire

✔ Jamaica

✔ Sint Marten

✔ The British Virgin Islands

✔ Montserrat

✔ Trinidad and Tobago

✔ Curaçao

✔ Saba

Least Developed Countries

✔ Islamic Republic of Afghanistan

✔ Chad

✔ Guinea-Bissau

✔ Angola

✔ Comoros

✔ Haiti

✔ Bangladesh

✔ Democratic Republic of Congo (also known as Congo-Kinshasa)

✔ Republic of Kiribati

✔ Benin

✔ Djibouti

✔ Laos

✔ Butan

✔ Republic of Equatorial Guinea

✔ Lesotho

✔ Burkina Faso

✔ Eritrea

✔ Liberia

✔ Republic of Burundi

✔ Ethiopia

✔ Republic of Madagascar

✔ Cambodia

✔ Gambia

✔ Malawi

✔ The Central African Republic

✔ Guinea

✔ Republic of Mali

Countries That Are Non-TAA Compliant

As of the date of writing, roughly 76 countries are not recognized as being TAA-compliant. According to amtgov.com, they include the following:

✘ Federative Republic of Brazil

✘ The Islamic Republic of Iran,

✘ Islamic Republic of Pakistan

✘ People’s Republic of China

✘ Republic of Iraq

✘ Russian Federation

✘ Republic of India

✘ Malaysia

✘ Democratic Socialist Republic of Sri Lanka

✘ Republic of Indonesia

Products and/or services manufactured or substantially transformed in these non-TAA-compliant countries violate the terms set forth by the TAA unless specific exceptions exist.

Is TAA Compliance Enforced?

TAA compliance was somewhat loosely controlled; however, in the past several years, that has changed significantly. These days, the government has made TAA compliance a priority. As a matter of fact, TAA compliance has become such a hot issue that vendors are even policing their competition. Recent TAA audits have led to the suspension of contractors, fines, and penalties. The government is serious.

Does TAA Apply to My Organization and Why Is TAA Compliance Important?

Certainly, it does if you have a GSA Schedule contract. However, TAA compliance is only required for federal procurement. The regulations state that government agencies cannot purchase non-TAA-compliant goods and services for contracts above $180,000. It is important to note that nearly every federal contract is above the $180,000 threshold.

The TAA does not limit foreign trade for any entities outside of the federal government. Therefore, non-TAA-compliant products can be sold freely on the commercial market. However, you probably have already found that there is an increasing TAA consciousness. Many entities refuse to buy any product that is not TAA compliant. You may even be asked to indemnify your products against any damage that can arise from TAA noncompliance. For most contractors, it is advantageous to understand TAA and be able to show their products to be TAA compliant.

TAA compliance is important to our country. The goals of the TAA are to implement trade agreements that foster the growth of an open and fair world trading system, expand our country’s commerce opportunities in international trade, and improve and enforce international trade rules. And TAA compliance can be vital to you. For example, being TAA compliant can give you access to lucrative government contracts.

How Can I Ensure My Product Is TAA Compliant?

If you want to be sure you are complying with TAA requirements, there are eight vital steps you can take:

✔ Make sure you use a reputable, TAA-compliant manufacturer.

✔ Keep copies of every agreement with your supplier, including a letter of supply.

✔ Always have the complete and correct documentation of the country of origin (e.g., accurate country of origin code and origin markings).

✔ Keep a detailed inventory of sample products, product markings, and product matching.

✔ Always keep up-to-date on any new U.S. Customs Border Protection information.

✔ Engage in product market sampling and training on a regular basis.

✔ If you think you have an issue, research it and remove it quickly.

✔ Get professional help if you are doing significant business with a country that is not TAA compliant.