In a new report published by Grand View Research, Inc., the global LED lighting market size is expected to reach USD 127.84 billion by 2027, exhibiting a compound annual growth rate (CAGR) of 10.8% over this forecast period. Factors driving the trend are the aggressive decline in LED lamp and luminaire pricing, longer lifespan, low heat emission, and improved energy efficiency. Power over Ethernet (PoE) power sourcing equipment is another contributing factor. Additionally, updates to global energy policies, hefty rebates, and incentives from government agencies for LED light implementation is expected to boost product demand further.

Despite this exciting growth trajectory, Versa Technology often hears from partners and business buyers that they are aware of PoE lighting, but that they have a difficult time selling new technology to their customers. This resistance to change is nothing new, and the truth of the matter is that new PoE lighting systems and hardware are superior in efficiency and attractiveness to earlier products, especially when used with the new management platforms.

Those who get on board early, the early buyers, stand to save some money. Their operations become more efficient, and products benefit the people who occupy their buildings. These customers are unthreatened by any learning curve attached. They love the excitement of being part of a new wave.

When a customer, however, is not rushing to purchase new lighting systems as expected, it’s important to realize there’s nothing wrong. This buyer is different. The apparent disconnect is not in how that business is developing its lighting products but rather in how it needs to present that new technology to the buyer.

This blog will explain two of the five basic types of new technology product adoption and how to address customer resistance by providing the right incentives. Realizing this behavior tendency and that it might take a little more time for certain buyer types will make this process smoother.

The five types of technology customer

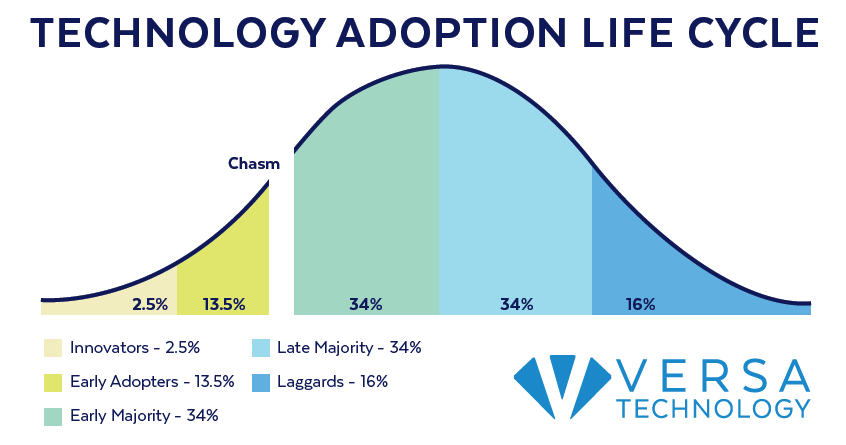

Geoffrey A. Moore, in his groundbreaking book Crossing the Chasm (review here), discusses the way consumers get on board with new, disruptive technologies.

The five types of technology customer are as follows:

- The Innovators

- The Early Adopters

- The Early Majority

- The Late Majority

- The Laggards

Each of these types, either embraces or resists change in a unique way. Marketers also need to understand the two basic types of disruption.

Each of these types, either embraces or resists change in a unique way. Marketers also need to understand the two basic types of disruption.

- The first type is disruptive or discontinuous innovation. This type gets the buyer to change his behaviors and the product he uses.

- The second type is sustaining or continuous innovation. This type focuses on steady improvements and upgrades without making the customer change his behavior.

The key to successful adoption with many customers rests with how much the customer needs to adapt (in one fell swoop) with the disruption your product creates.

- Innovators love technology. That’s what draws them in.

- Early Adopters are attracted by what they perceive as a potential benefit.

- Early Majority are pragmatic and need to measure value before they act.

- Late Majority buyers like the status quo. They will adopt once technologies become established.

- Laggards for cultural or economic reasons are not interested in new technologies.

Internal reasoning is the key

Between the Early Adopter and the Early Majority, who look strangely similar on the surface, is something Moore calls the chasm. To provide more explanation, here is how Moore describes the two groups.

- Early Adopters are quick to understand the benefits of new technology. Unlike the Innovators, they don’t love technology for its own sake. This group relies on its own intuition and vision to make buying decisions. They are unfazed by product improvements and adjustments.

- Early Majority are practical-minded consumers. If a product seems useful, this group will try it. The Early Majority are cautious of fads. They need the reassurance of success stories and baselines to move into action.

How do people decide how they are going to buy? Look at it from a financial point of view.

“Disruptive technology, regardless of type or industry, follows a common thread,” states Peter Brown, a 30-year lighting industry veteran and consultant for Lighting Transitions. “The key barrier to adoption beyond the Innovators and Early Adopters (15%) is the lack of clearly defined value. ‘If it doesn’t have a three-year payback, we’re not interested.’ Most non energy benefits for advanced controls do not have clearly defined paybacks. This is due to a lack of existing baselines on which to compare a new system. No baseline, no comparison, no payback or ROI.”

PoE Lighting: Appealing to the pragmatist

Mr. Brown recently presented on Mega Trends Impacting the Buying of Connected Lighting. He spoke at Strategies in Light in San Diego. He spoke on logistical objections, and in this, it all boils down to financial transactions. The reason why the LED bulb has caught on with such intensity is that the bulbs were less expensive. They might require more money to purchase, but they last much longer while producing better light and using less energy. That’s finance.

When asked what he thought could speed up the process of baseline development for lighting systems, Brown said there are some limited applications where baselines exist. Patient improvement in certain long-term healthcare facilities is definitely one. Occupants in office buildings, for example, go home at night and spend the rest of their 24-hour period in a mish-mash of lighting environments and engage in any number of other outlying behaviors where it’s not possible to provide a control group solely impacted by PoE LED lighting spectrums. Conversely, patients in long-term healthcare spend 24-hours a day in a controlled environment. The benefits of LED lighting on people with Dementia and Alzheimers are evident. Providers are seeing improvement in their patient’s cognitive abilities that they can directly attribute to the result of these advanced lighting systems. These benefits can be measured. This is the type of information that Early Majority buyers need to purchase lighting systems.

It’s only a matter of time before other baselines begin to emerge. For more on PoE power sourcing equipment used to support lighting systems, check out our product page.